Sep 14, 2020, 7:46:07 AM

Apple Inc.: wave analysis

The price may grow.

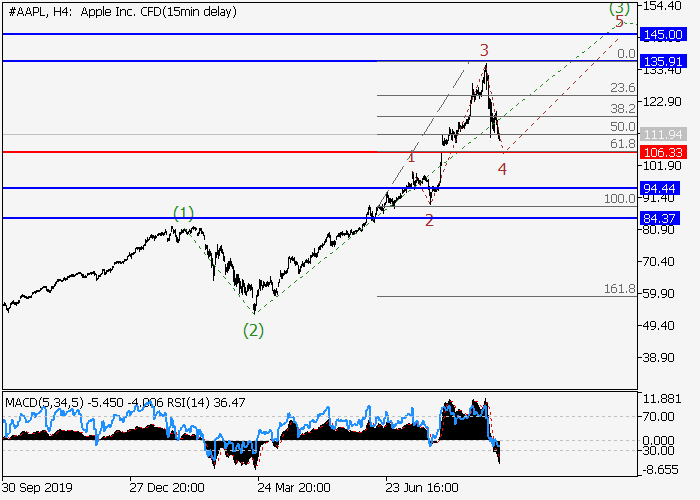

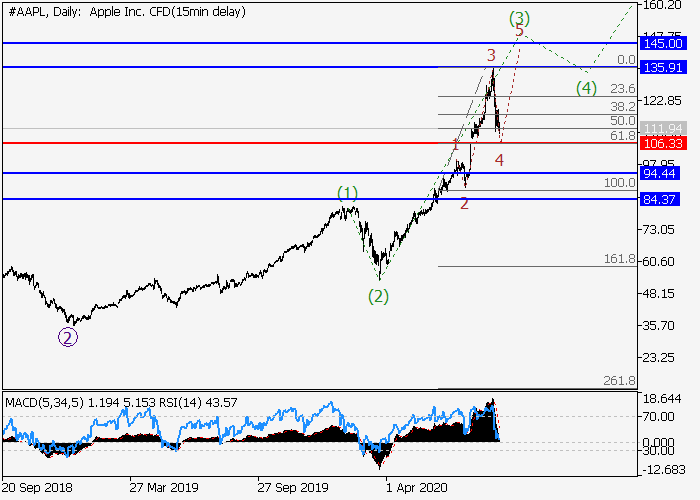

On the daily chart, the third wave of the higher level 3 develops, within which the wave (3) of 3 forms. Now, a local correction is ending to develop as the fourth wave of the lower level 4 of (3). If the assumption is correct, after the end of the correction, the price will grow within the wave 5 of (3) to the levels of 135.91–145.00. In this scenario, critical stop loss level is 106.33.

Main scenario

Long positions will become relevant after the end of the correction, above the level of 106.33 with the targets at 135.91–145.00. Implementation period: 7 days and more.

Alternative scenario

The breakdown and the consolidation of the price below the level of 106.33 will let the price go down to the levels of 94.44–84.37.

Scenario

-

Timeframe

Weekly

-

Recommendation

BUY

-

Entry Point

112.31

-

Take Profit

135.91, 145.00

-

Stop Loss

106.33

-

Key Levels

84.37, 94.44, 106.33, 135.91, 145.00

Alternative scenario

-

Timeframe

Weekly

-

Recommendation

SELL STOP

-

Entry Point

106.30

-

Take Profit

94.44, 84.37

-

Stop Loss

110.25

-

Key Levels

84.37, 94.44, 106.33, 135.91, 145.00