Sep 16, 2020, 8:56:28 AM

USD/CAD: flat dynamics develop

Current trend

Today during the Asian session, the USD/CAD pair is slightly declining, correcting after an uncertain growth yesterday. Macroeconomic statistics from the US and Canada released on Tuesday were rather poor. Thus, the volume of American industrial production for August fell from +3.5% MoM to +0.4% MoM, which was significantly worse than market expectations of +1% MoM. Canadian data was disappointing with a sharp decline in manufacturing sales. For July, the indicator decreased from +23% MoM to +7% MoM, with forecasts for a reduction to +8.7% MoM.

On Wednesday, investors are focused on the publication of the minutes of the two-day Fed meeting on interest rates. As before, the market does not expect sharp changes in the vector of monetary policy but verbal interventions are still possible. Canada will publish a block of August data on the dynamics of consumer prices, which, given the optimistic forecasts of analysts, may provide significant support to the national currency.

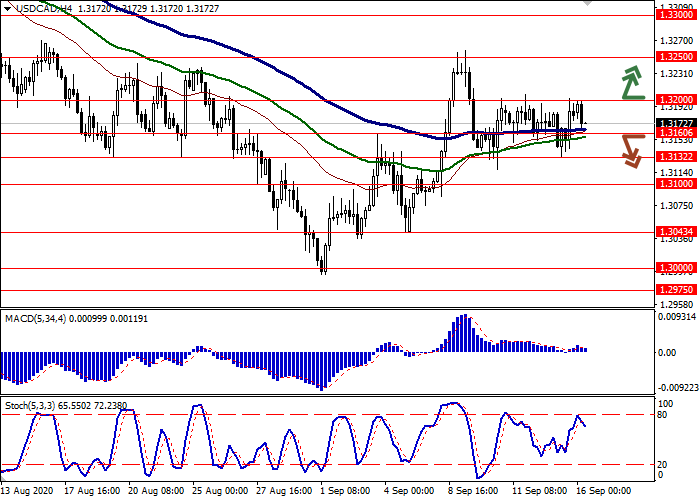

Support and resistance

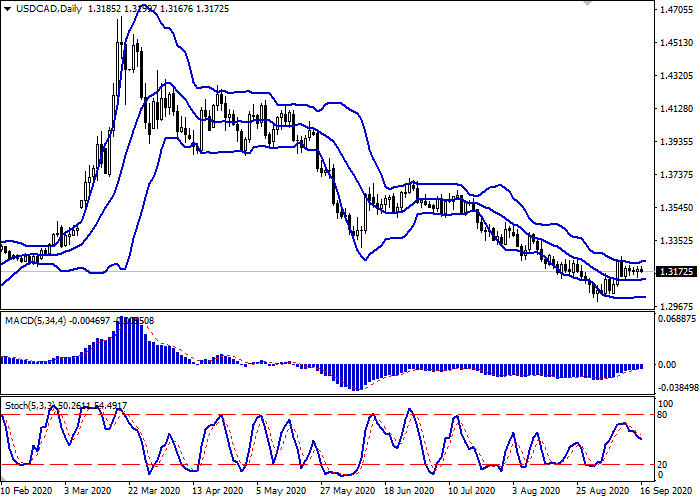

On the daily chart, Bollinger Bands reverse into a horizontal plane. The price range does not change significantly, indicating a multidirectional nature of trading in the short term. The MACD indicator grows, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, by contrast, maintains a relatively solid downward thrust, signaling in favor of the development of the “bearish” dynamics in the ultra-short term.

Resistance levels: 1.3200, 1.3250, 1.3300.

Support levels: 1.3160, 1.3132, 1.3100, 1.3043.

Trading tips

Long positions may be opened after the breakout of 1.3200 with the target at 1.3250. Stop loss – 1.3175. Implementation period: 1–2 days.

Short positions may be opened after the breakdown of 1.3160 with the target at 1.3100. Stop loss – 1.3200. Implementation period: 2–3 days.

Scenario

-

Timeframe

Intraday

-

Recommendation

BUY STOP

-

Entry Point

1.3205

-

Take Profit

1.3250

-

Stop Loss

1.3175

-

Key Levels

1.3043, 1.3100, 1.3132, 1.3160, 1.3200, 1.3250, 1.3300

Alternative scenario

-

Timeframe

Intraday

-

Recommendation

SELL STOP

-

Entry Point

1.3155

-

Take Profit

1.3100

-

Stop Loss

1.3200

-

Key Levels

1.3043, 1.3100, 1.3132, 1.3160, 1.3200, 1.3250, 1.3300