Sep 16, 2020, 8:24:56 AM

EUR/USD: ambiguous dynamics

Current trend

EUR is trading near zero against USD during today's Asian session, hovering at 1.1850. The day before, EUR managed to demonstrate moderate growth against USD and even updated local highs since September 10, but the "bulls" failed to consolidated at new levels (at 1.1900). The instrument was supported moderately by the data from Germany, released on Tuesday. ZEW Economic Sentiment in September rose from 71.5 to 77.4 points, which turned out to be better than the negative forecasts, which assumed a decrease in the indicator to 69.8 points. In the euro area, ZEW Survey showed a moderate increase in Economic Sentiment in September from 64 to 73.9 points, which also exceeded the projected 62.8 points.

Today, investors are focused on the publication of the final minutes of the two-day Fed meeting on the interest rate. In addition, traders are awaiting the release of the August statistics on the dynamics of retail sales in the United States.

Support and resistance

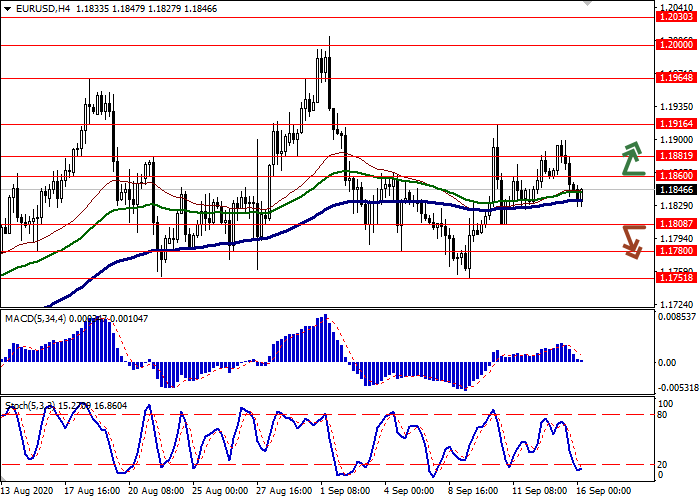

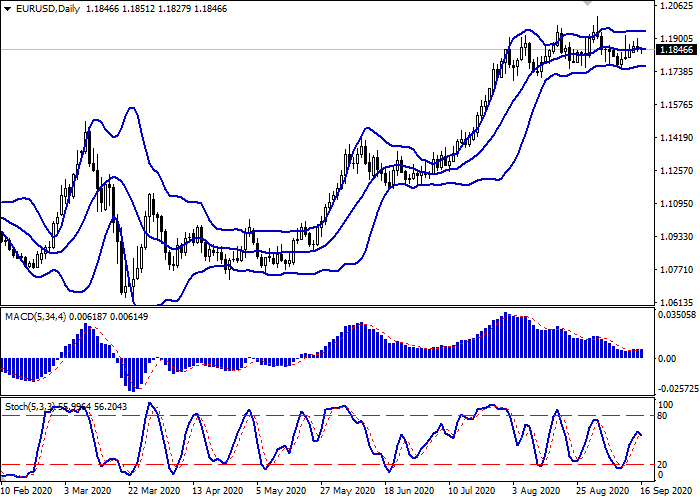

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic interrupted active growth and is inclined to reverse downwards, reacting to the "bearish" dynamics of Tuesday.

To open new positions, it is necessary to wait for the trade signals to become clear.

Resistance levels: 1.1860, 1.1881, 1.1916, 1.1964.

Support levels: 1.1808, 1.1780, 1.1751, 1.1700.

Trading tips

To open long positions, one can rely on the breakout of 1.1860. Take-profit – 1.1916. Stop-loss – 1.1830.

The breakdown of 1.1808 may serve as a signal to new sales with the target at 1.1751. Stop-loss – 1.1840.

Implementation time: 1-2 days.

Scenario

-

Timeframe

Intraday

-

Recommendation

BUY STOP

-

Entry Point

1.1865

-

Take Profit

1.1916

-

Stop Loss

1.1830

-

Key Levels

1.1700, 1.1751, 1.1780, 1.1808, 1.1860, 1.1881, 1.1916, 1.1964

Alternative scenario

-

Timeframe

Intraday

-

Recommendation

SELL STOP

-

Entry Point

1.1805

-

Take Profit

1.1751

-

Stop Loss

1.1840

-

Key Levels

1.1700, 1.1751, 1.1780, 1.1808, 1.1860, 1.1881, 1.1916, 1.1964