Sep 17, 2020, 9:13:22 AM

EUR/TRY: euro weakens

Current trend

Today during the Asian session, the EUR/TRY pair is moderately declining, retreating from record highs, renewed last Tuesday. The euro is weakening on the back of moderate growth in the US currency, which was moderately supported by the publication of the minutes of the Fed meeting on Wednesday, September 16. The Turkish lira, in turn, remains under pressure after the rating agency Moody's downgraded Turkey's long-term credit rating from B1 to B2 this week, pointing out the difficulties in the current economic situation and the growing balance of payments deficit.

On Thursday, investors are focused on a block of macroeconomic statistics from the EU on the dynamics of consumer inflation. It is predicted that the August inflation in the region will maintain the same rate of decline at the levels of 0.4% MoM and 0.2% YoY. Also, during the day, the markets are awaiting a speech by ECB Vice President Luis de Guindos.

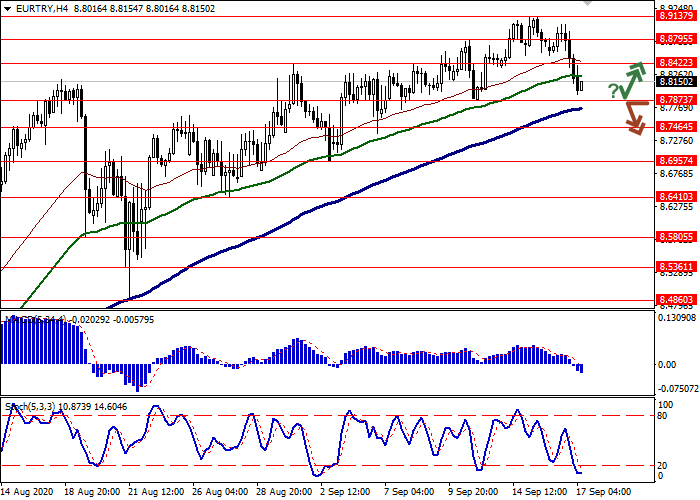

Support and resistance

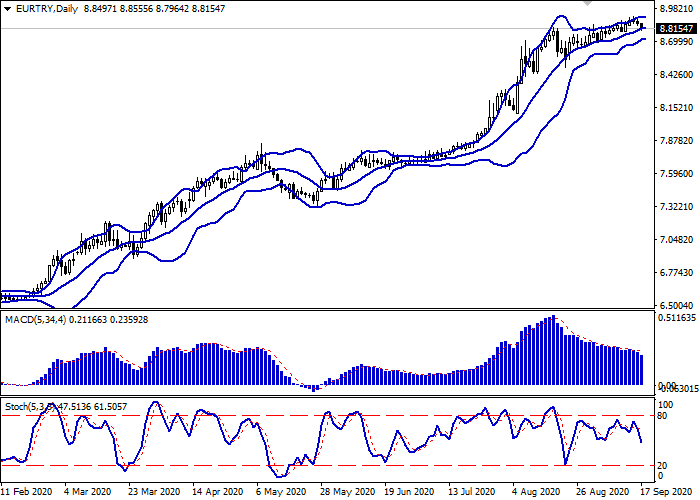

On the daily chart, Bollinger Bands reverse into a horizontal plane. The price range tries to consolidate, indicating the ambiguous nature of trading over the past few days. MACD falls, maintaining a strong sell signal (the histogram is confidently below the signal line). Stochastic demonstrates a similar dynamics, located approximately in the center of its working area.

It is better to keep current short positions and open new ones until the signals from technical indicators are clarified.

Resistance levels: 8.8422, 8.8795, 8.9137.

Support levels: 8.7873, 8.7464, 8.6957, 8.6410.

Trading tips

Long positions may be opened after a rebound from 8.7873 and the breakout of 8.8422 with the target at 8.9137. Stop loss – 8.7873.

Short positions may be opened after the breakdown of 8.7873 with the target at 8.6957. Stop loss – 8.8422.

Implementation period: 2–3 days.

Scenario

-

Timeframe

Intraday

-

Recommendation

BUY

-

Entry Point

8.8655

-

Take Profit

8.9137

-

Stop Loss

8.8495

-

Key Levels

8.6410, 8.6957, 8.7464, 8.7873, 8.8422, 8.8795, 8.9137

Alternative scenario

-

Timeframe

Intraday

-

Recommendation

SELL STOP

-

Entry Point

8.7870

-

Take Profit

8.6957

-

Stop Loss

8.8422

-

Key Levels

8.6410, 8.6957, 8.7464, 8.7873, 8.8422, 8.8795, 8.9137